The report paints a bleak image of socio-economic circumstances because the Taliban returned to energy in August 2021, with the erosion of ladies’s rights and a banking system close to collapse, recognized as main areas of concern.

The Afghan financial system has not recovered from the cumulative 27 per cent shrinkage skilled since 2020 and seems to be stabilizing at a really low degree of exercise.

Restrictions and disruptions

That is largely as a result of restrictions on the banking sector, disruptions in commerce and commerce, weakened and remoted public establishments and nearly no overseas funding and donor assist for sectors akin to agriculture and manufacturing.

Public establishments, notably within the financial sector, proceed to lose technical experience and capabilities, together with ladies workers, which is additional exacerbating the state of affairs.

Though progress has been made in some areas – together with in sustaining stability and safety, and controlling opium manufacturing and illicit commerce – it has not been sufficient to vary the nation’s trajectory.

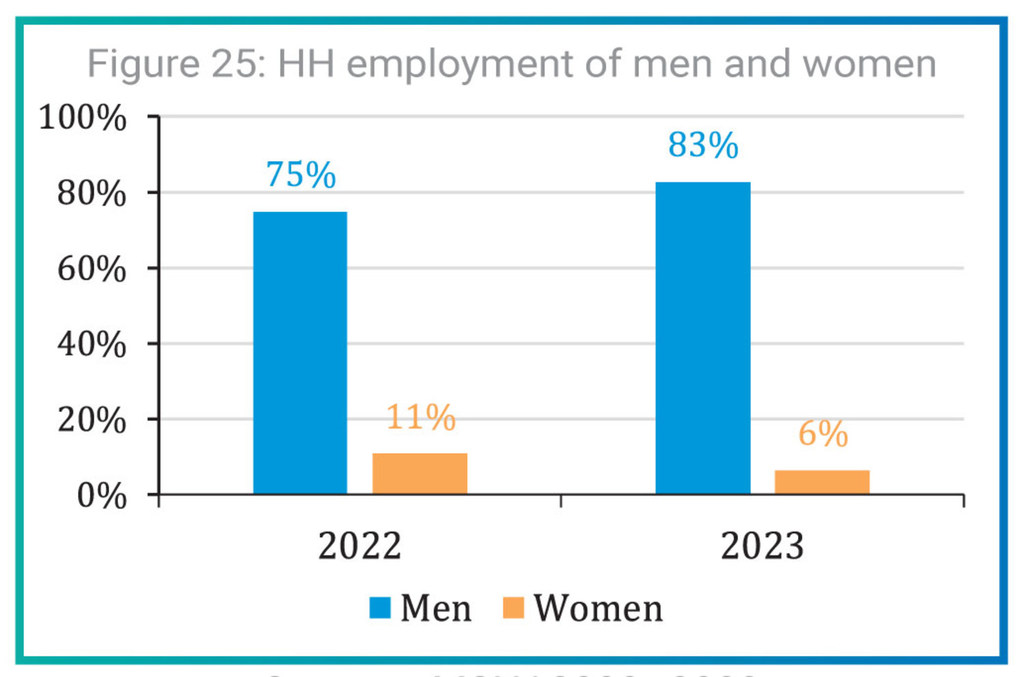

Sources: UNDP MSNA2022–2023

Ladies’s employment in Afghanistan decreased practically by half.

Extreme affect on ladies

Moreover, the humanitarian and financial crises, in addition to restrictions on ladies’s rights, have had a extreme affect on the feminine inhabitants.

Ladies not solely have restricted entry to public areas, in addition they now devour much less meals and expertise better earnings inequality in comparison with males. The proportion of ladies working throughout all sectors has additionally dropped dramatically, from 11 per cent in 2022 to simply six per cent this yr.

The report additionally introduces the Subsistence-Insecurity Index (SII), which utilises 17 non-monetary indicators throughout three dimensions to measure deprivation.

Almost 70 per cent of Afghans are unable to fulfil their primary wants for meals, healthcare, employment and different every day necessities, in accordance with the index.

Decline in overseas assist

Worldwide help has been important in Afghanistan. It has saved tens of millions from hunger, prevented 1000’s of livelihoods and microenterprises from disappearing, and helped stave off financial collapse.

Nonetheless, assist flows are declining at a time when an awesome majority the inhabitants stays extremely susceptible, mentioned Stephen Rodriques, UNDP Resident Consultant within the nation.

“The help and efforts require complementary funding to stimulate the restoration of the non-public sector, monetary system, and total manufacturing capability of the financial system,” he mentioned.

Put ladies first

The report pressured the necessity to handle challenges within the banking system, together with the microfinance sector – essential for supporting women-led micro and small enterprises, which have skilled a 60 per cent contraction since 2021.

Ladies’s financial participation have to be on the forefront of any efforts aimed toward addressing the crises in Afghanistan, UNDP mentioned.

The company known as for integrating native financial growth, resilience in opposition to shocks and strong non-public sector-led progress to maintain livelihoods.