WASHINGTON DC, Feb 19 (IPS) – Chile’s economic system is at a crossroads. Sturdy insurance policies have efficiently introduced down excessive inflation and lowered the massive present account deficit that emerged through the pandemic. Will increase in social advantages have supplied some aid in response to discontent over inequality.

Nevertheless, funding and development are nonetheless tepid and social gaps stay excessive.

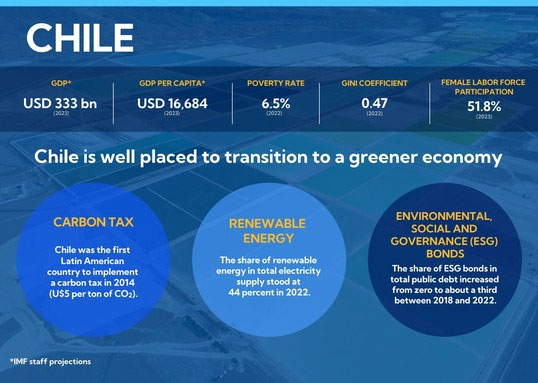

Going ahead, Chile—the world’s largest copper producer, second largest lithium producer, and richly endowed with photo voltaic and wind—can each contribute to, and profit from, the worldwide inexperienced transition.

A extra dynamic and greener economic system might additionally create situations for larger fairness and inclusion.

Boosting financial exercise

Chile has a comparative benefit in renewable power manufacturing. Prices of electrical energy era are decrease for photo voltaic and wind than fossil fuels due to the excessive photo voltaic radiation in Chile’s north and robust winds within the south.

Already, electrical energy generated from photo voltaic and wind elevated from 1 to 23 % of whole electrical energy provide throughout 2010–22.

Our estimates recommend that changing coal with renewable power, alongside the traces of the authorities’ plans to decommission coal-fired energy crops by 2040, might enhance financial exercise by at the very least 1 % over the long run.

Such a shift within the power combine would suggest an almost 30 % value discount in electrical energy era, along with the advantages from decrease carbon emissions and air air pollution. A shift in Chile’s power combine would additionally considerably strengthen the economic system’s resilience in opposition to future coal and gas worth shocks.

Growth of the inexperienced hydrogen trade might provide extra development prospects, conditional on additional reductions within the manufacturing and transportation prices. The geographic mismatch between energy era and consumption is the principle bottleneck for larger use of renewable power.

Particularly, the areas wealthy in photo voltaic and wind within the northern and southern components of Chile are greater than 1,000 miles away from its financial hub within the central space. This might be resolved by upgrading the transmission community, together with by means of the brand new Kimal-Lo Aguirre transmission line set to grow to be operational in 2029.

New alternatives

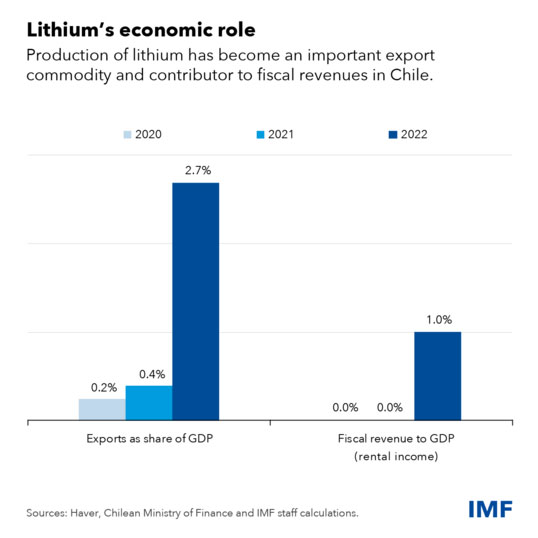

Chile additionally has a possibility to play a job in international efforts to cut back carbon emissions. This includes the larger use of lithium for power storage in batteries. The ensuing greater international demand for lithium gives prospects to increase Chile’s lithium manufacturing and associated industries alongside the worth chain, whereas balancing social and environmental aims.

For Chile, lithium has already grow to be an necessary supply of exports and monetary income lately when the lithium worth surged. The nation is planning to increase its lithium manufacturing by means of public-private partnerships.

Offering a transparent institutional framework for traders that may be swiftly applied as international demand ramps up will probably be an necessary issue to additional develop the trade.

Extra funding wanted

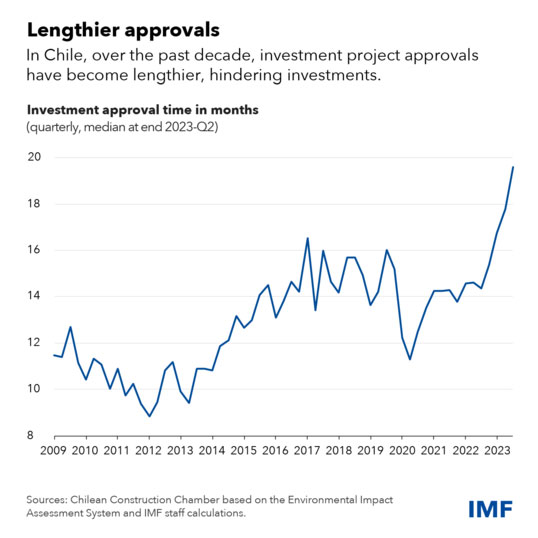

Whereas Chile’s economic system is projected to renew development in 2024, its common actual financial development charge has been declining for a few years alongside adverse productiveness development. Subsequently, strengthening funding is important to sustainably increase and diversify financial exercise.

Funding approvals have grow to be extra sophisticated, unsure, and lengthier through the years, largely reflecting extra advanced safeguards for the setting, well being, security, social issues, and a bigger variety of stakeholders.

The federal government’s ongoing efforts to streamline and enhance coordination of allowing processes, whereas sustaining excessive environmental requirements, might contribute to lifting much-needed funding and produce significant development dividends.

Supply: Worldwide Financial Fund (IMF), Washington DC

Luiza Antoun de Almeida is an Economist, Si Guo is a Senior Economist, and Andrea Schaechter is an Assistant Director within the Western Hemisphere Division.

IPS UN Bureau

© Inter Press Service (2024) — All Rights ReservedOriginal source: Inter Press Service